Gifts that Give Back

Giving Solutions That Return Income to Increase Giving

Click on an item below for specific instructions on how to make a gift to your fund at the PCA Foundation, Inc.

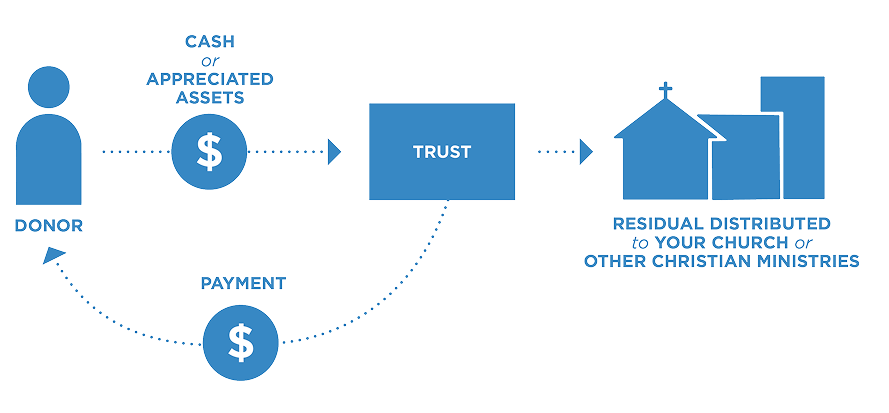

Charitable Remainder Trusts

A Charitable Remainder Trust (CRT) through the PCA Foundation allows you to give in a way that blesses both you and the ministry you love. You receive an immediate tax deduction, and the trust pays you—or others you name—an income stream for life or for a term up to 20 years. After that, the remainder comes to us or to your donor-advised fund, to be granted to various ministries you support.

CRTs offer secure income, tax-free growth, and a larger deduction than if you gave the same gift later. You can even fund the trust with appreciated assets, such as real estate or a business, and avoid capital gains taxes when the trust sells the asset—resulting in higher income for you and a larger gift to ministry.

CRTs are flexible and can be tailored to your specific giving and income goals. You may create one during your lifetime or through your will, and you can choose from a variety of investment options. Download PCAF’s informative guide to learn more about the advantages of a Charitable Remainder Trust.

Charitable Gift Annuities

If you plan to make a large charitable gift but need income in the meantime, a Charitable Gift Annuity may be a wise option. You give now, receive an immediate deduction, and enjoy steady income for life (or for a term up to 20 years). After that, the remainder of your gift comes to us, or your PCA Foundation donor-advised fund for distribution to multiple Kingdom causes.

It’s a way to give generously—without giving up financial security. The annuity provides predictable income while supporting ministry in the future.

A Charitable Gift Annuity allows you to give effectively and efficiently while sustaining a predictable monthly income stream. Contact the PCA Foundation to learn more.

Charitable Lead Trusts

A Charitable Lead Trust (CLT) operates the reverse of a CRT. It first pays an income stream—often for a set number of years— to us or into your PCA Foundation donor-advised fund. After that period, the remaining assets go to your heirs (or in some cases, back to you).

CLTs can be a powerful tool for reducing estate or gift taxes, or for accelerating deductions in high-income years. Whether you set it up during your lifetime or through your estate, a CLT helps you shift wealth from taxes to Kingdom impact.

At the end of the trust term, assets are distributed:

1. Back to the donor (in a Grantor Lead Trust), or

2. To heirs or beneficiaries (in a Non-Grantor Lead Trust).

As with any complex gift strategy, we recommend working with a trusted advisor—the PCA Foundation can help you structure your giving in a way that aligns with both your financial goals and your heart for ministry.