Non-Cash Gifts

Give Before Sale, Double the Tax Savings

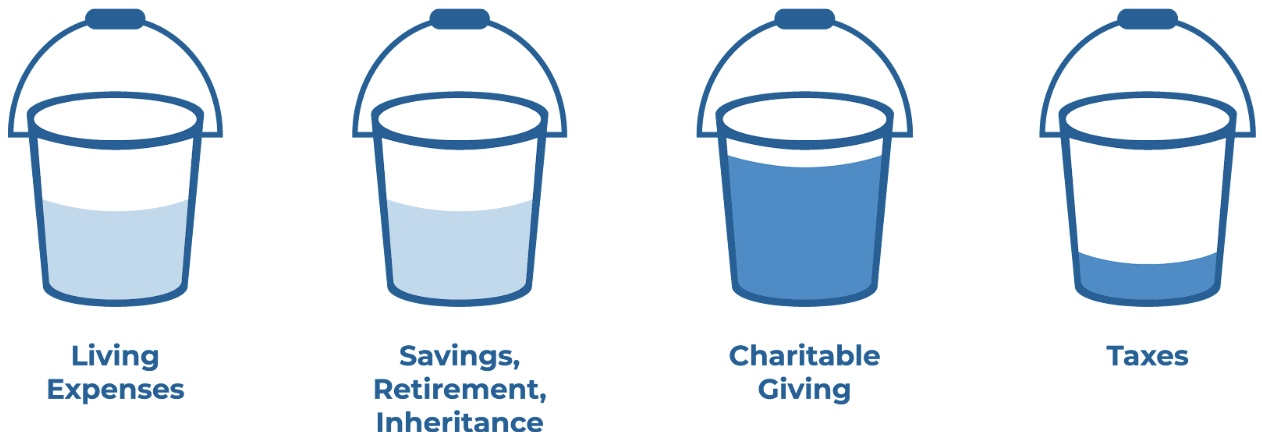

Many church members can greatly increase the amount they have for giving, by even 30% to 40%, while also accomplishing personal financial and estate goals, just by giving at certain times, giving certain non-cash assets, or giving in certain ways. Envision four “buckets” for your income and wealth:

The love of Christ spread across our hearts determines the allocation among the first three buckets, and should be a matter for the Holy Spirit’s work, not manipulation by professional fundraisers and stewardship teachers. Once you have determined in your heart the three bucket amounts, thanks to tax rules, you can give at certain times, give certain assets, and give in certain ways that decrease the fourth bucket, taxes, and thereby increase the third, charitable giving, without reducing what you have determined for consumption and your personal estate.

The income tax deduction and resulting tax subsidy effectively decrease the cost of giving and thereby enable more of it. And certain kinds of giving decrease its cost and enable more of it to a much greater extent than does cash giving for immediate charitable needs or simple estate giving, frequently while also accomplishing certain personal financial and estate objectives.

Click on an item below for specific instructions on how to make a gift to your fund at the PCA Foundation, Inc.

Stocks and Bonds

Donating appreciated stock, mutual funds, or bonds instead of cash allows you to avoid capital gains taxes and receive a deduction for the full market value—maximizing both your tax savings and your gift.

The PCA Foundation’s experienced team and established brokerage processes make it easy to give. You can direct your gift into a fund already established for our church, or set up your own donor-advised fund.

To get started, visit the PCA Foundation’s gifting instructions page and click on the appropriate category: for stocks, funds and bonds via electronic transfer, or via transfer of stock certificates.

Real Estate Gifts

Through the PCA Foundation, you can donate developed or undeveloped real estate and receive a full market value deduction while avoiding capital gains tax. You may even give partial ownership if you wish to retain some equity.

As with all non-cash gifts, it is important to remember that the IRS will treat the sale as taxable if you enter into a binding sales contract before you donate the property. It is important to have your initial conversation with the PCA Foundation as early as possible if you are considering a real estate gift. Their experts will help you navigate the complexities of the real estate donation while maximizing your giving potential.

This is even more crucial if you have debt on the property, as substantial debt can have an adverse effect on your ability to give the property. It is typically advantageous to pay off all debt before donating the property. Make sure to inform PCAF of all debt and taxes due.

Cryptocurrency Gifts

Cryptocurrency is a newer type of asset, but it can make a highly effective charitable gift. Because crypto often has a low cost basis and significant appreciation, selling it can trigger a large tax bill. But when you donate it instead, you avoid capital gains taxes and can deduct the full market value of the asset—just like other non-cash gifts.

Through the PCA Foundation, you can donate your cryptocurrency directly to support our church. Once received, the Foundation will liquidate the crypto and place the proceeds into our fund. Alternatively, you can establish a donor-advised fund to support multiple ministries over time.

You can begin the process by filling out this form!

S Corporation Gifts

Donating S Corporation stock can significantly reduce your taxes. While charities must pay tax on income from S Corp stock, the PCA Foundation’s charitable trust structure allows them to offset up to 50% of that cost—restoring much of your intended impact. Through this structure, more of your gift goes to ministry rather than taxes. And if the value of your business and your level of generosity continue to grow, even more can be redirected from taxes to Kingdom work.

If the business is being sold, avoid entering a binding sale agreement before donating. The PCA Foundation can help you navigate complexities, especially if there is debt involved. Also note that they cannot hold more than 20% of a business (including related party shares) for over five years. To help ensure compliance, you’ll be asked to list any related holdings when completing the gift form—unless the business only holds real estate and is not actively operating.

You can give directly to our church’s fund or through a donor-advised fund for broader impact

Partnership Interest Gifts

When you give units in a Limited Liability Company or Partnership through the PCA Foundation, taxes on the sale of that LLC or LLP can be avoided completely. Once sold, the proceeds can support our church or multiple ministries via a donor-advised fund.

As with other non-cash gifts, avoid binding sale agreements beforehand, and disclose any debt. The PCA Foundation cannot hold more than 20% of the business (including shares owned by related parties) for more than five years. To help ensure compliance, you’ll be asked to list any related holdings when completing the gift form—unless the business only holds real estate and is not actively operating.

C Corporation Gifts

Gifting C Corporation stock allows you to bypass capital gains entirely and claim a deduction for the appreciated value. Once the stock is sold, proceeds go to our fund or a donor-advised fund you control.

As with all non-cash gifts, it is important to remember that the IRS will treat the sale as taxable if you enter into a binding sales contract before you donate the property. It is important to have your initial conversation with the PCA Foundation as early as possible if you are considering a C Corporation gift tied to the sale of the corporation. Their experts will help you navigate the complexities of the real estate donation while maximizing your giving potential. This is even more crucial if you have debt, as substantial debt can have an adverse effect on your ability to give the C Corporation stock. It is typically advantageous to pay off all debt before donating the property. Make sure to inform PCAF of all debt and taxes due.

If you are considering a gift of business ownership, it’s important to know that the PCA Foundation cannot hold more than 20% of a company (including shares owned by related parties) for more than five years. To help ensure compliance, you’ll be asked to list any related holdings when completing the gift form—unless the business only holds real estate and is not actively operating.

Incentive Stock Options

Incentive Stock Options give a great opportunity to give. Although you cannot transfer an incentive stock option prior to death, once you’ve exercised and held incentive stock options for the required holding period, you can donate the shares—avoiding capital gains and deducting the full value. It’s a tax-smart way to give more to ministry, rather than to taxes.

The PCA Foundation can help you donate quickly and securely, either to our church’s fund or through a donor-advised fund.

Get started with this brief form!